Credit: Stanbic IBTC Bank

Stanbic IBTC Bank, one of Nigeria’s leading banks, has recently launched Senior Citizens Account, an innovative solution exclusively designed for customers aged 50 years and older. This initiative is expected to serve over 15 million Nigerians estimated to be within this age range, according to Index Mundi. Through this very thoughtful banking service for the elderly, the financial institution can provide tailored financial services solutions that meet the special needs of this unique clientele.

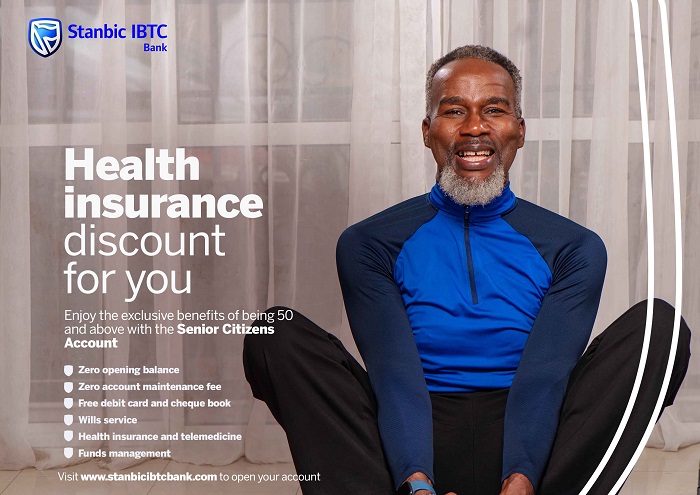

Senior Citizens Account is an all-encompassing banking solution designed to meet the immediate and long-term financial needs of individuals approaching retirement or those already in their retirement phase. The package comprises comprehensive features such as zero account opening balance, zero account maintenance fee, free debit card and cheque book, health insurance and telemedicine, wills service and funds management.

Wole Adeniyi, Chief Executive, Stanbic IBTC Bank, pointed out that this unique initiative underscores the synergy between the Bank and its sister organisations. It is an excellent opportunity for people who are nearing retirement to consolidate their banking needs, investments managements, wealth transfer across generations and for retirees who rely on Stanbic IBTC Pension Managers to manage their pension funds, to also use Stanbic IBTC Bank to receive their gratuity payments while enjoying excellent benefits. Senior Citizens Account aims to provide people in their 50s and older with essential support and services, ensuring their financial well-being and stability.

Senior Citizens Account is not just another banking product; it represents a paradigm shift towards creating a banking experience that significantly enhances its users’ lifestyles. It is crafted to offer senior citizens a sense of financial security, unparalleled convenience, and an improved sense of well-being. This commitment to exceeding customers’ expectations is further demonstrated by the Bank’s initiative to introduce cutting-edge features aimed at making banking services more accessible and convenient.

The Bank has substantially improved its technical infrastructure, reducing system downtime from 3% to a mere 0.5%. This reduction in downtime confirms the Bank’s dedication to providing reliable and uninterrupted service, ensuring that customers’ banking experiences are smooth and hassle-free.

Through these initiatives, Stanbic IBTC Bank reaffirms its commitment to innovation and customer satisfaction, aiming to bridge the gap between modern banking and the evolving needs of the ageing population. By developing products like Senior Citizens Account, the Bank addresses a previously overlooked market segment and sets new standards in offering tailored financial solutions that contribute to their overall quality of life.

For individuals interested in discovering more about Vitality Plus and the enrollment process, information is readily available at www.stanbicibtcbank.com or at any Stanbic IBTC Bank branch nationwide. This initiative is part of Stanbic IBTC Bank’s ongoing efforts to refine and adapt its services to meet the evolving needs of its customers better, ensuring that every client, regardless of age, has access to top-tier banking solutions that reflect their lifestyle and aspirations.

Kindly like, share and leave your comments.